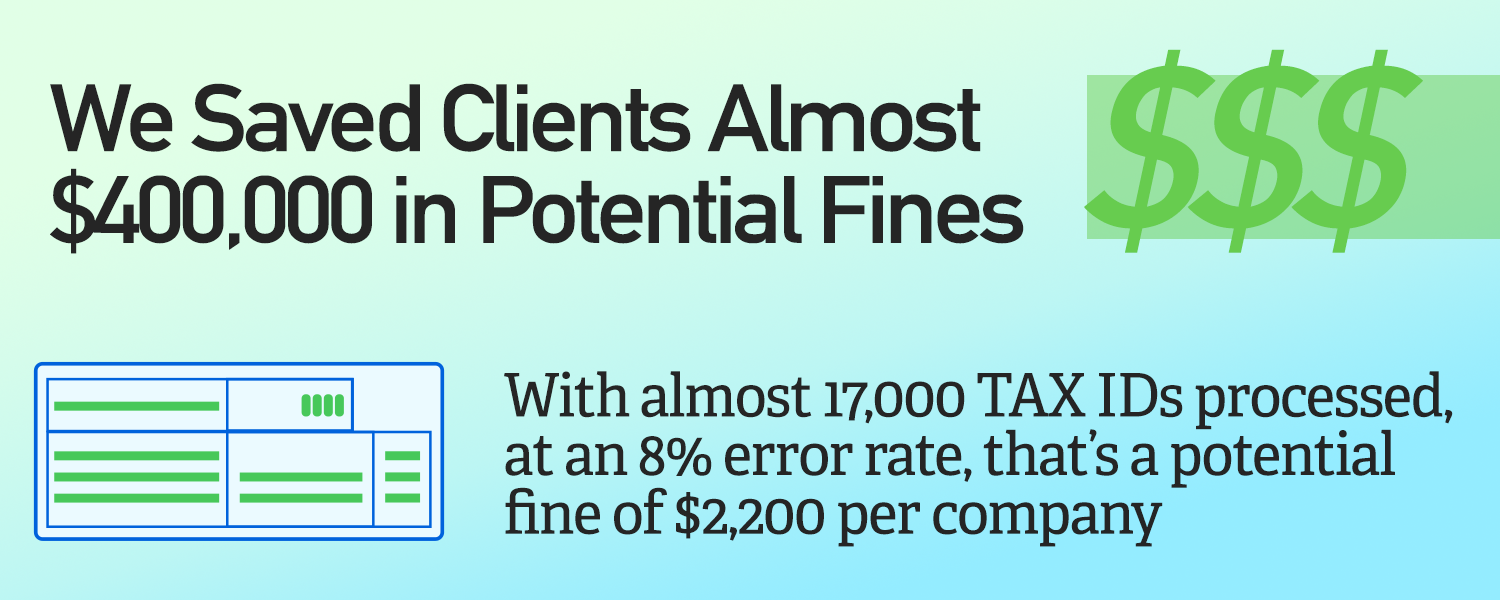

We Saved Our Clients Almost $400,000 in Potential Fines

Our 1099 filing is done! A few extensions have been filed and some corrections will inevitably have to be made, but the bulk of it is finished.

As part of our 1099-S process, we conduct a TIN (Taxpayer Identification Number) match where we are able to submit a seller’s name and social security number/employer id # and match them to the IRS and Social Security data bases. For 2021, we processed almost 17,000 individual Tax IDs for our clients before the 1099’s were actually filed thus avoiding several thousands of dollars in potential fines. As you may be aware, IRS can fine settlement agents up to $280.00 per incorrect 1099. In our work this year, we found an overall 8% error rate! The fines for these incorrect 1099’s would have aggregated almost $400,000! To bring this a little closer to home, for each 100 1099’s filed the potential fine to the settlement agent would have been about $2,200.

Can you afford to waste $2,200?

Uncertain about the quality of your 2021 1099-S filing? Call us today and let us look at your 1099s before the IRS gets around to it!

Our 1099-S Services

Don’t want to be bothered by filing 1099-S forms? Let Generes & Associates can take that burden from you! We also offer TIN matching services for complete peace of mind.