Market Trends: Rent & Mortgages Continue to Skyrocket Amidst Increasing Migration

A highly competitive market, stemming from high demand and a short supply of houses for sale is the continued cause of a flurry of activity for anyone working in the real estate sector. We'll break down the latest information, and give you our take on it. Remember, we have a number of services and solutions to accommodate all manner of companies in the title, settlement & escrow industry. Please reach out and let us know how we can help you. Now, let’s dive in!

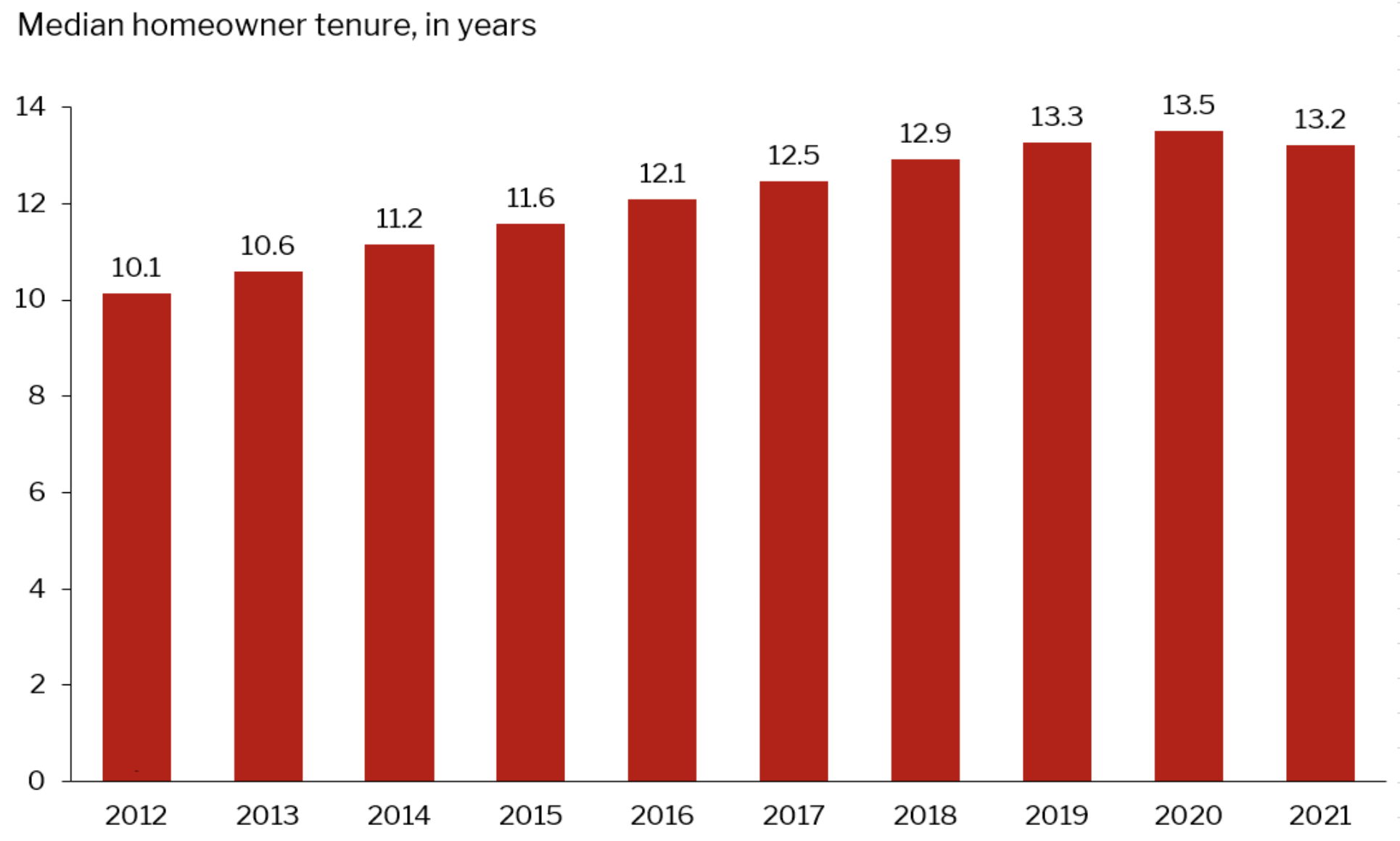

Homeowner Tenure Increasing Over Time

Source: Redfin.com

Homeowner tenure is defined by the number of years between the two most recent sale dates of any given home. According to Redfin, tenure has been generally increasing over time from a number of factors, including an aging population staying in place, people refinancing their homes--perhaps to take advantage of last years record low mortgage rates--and a highly competitive market with a short supply of housing, leading many to feel priced out.

Another contributing factor is rising rents, leading some homeowners to rent out their properties, instead of putting them on the market for sale. Keep this in mind, as we'll touch on this later.

While there was a slight dip in tenure in 2021 compared to 2020, it was only by 0.01 years below the 2019 rate, which was continuing to increase from years prior as well. It might be a little premature to point to the desire people have to get out of big cities as a marker that tenure will continue to decrease, and put more houses on the market. Other factors make that seem a bit less likely.

Rental Pricing Continues To Surge

While the homeowner tenure trend primarily accounts for an older demographic of the population, a younger demographic is facing a different, but inextricably linked trend: A surge in the average cost of rent across the nation. As of January of 2022, average rent was $1,789, a nearly 20% increase on the year. This continues a trend of steadily rising rents, post-lockdown.

The reality of remote work might be leading some millennials to question whether or not it makes more sense to buy. For a brief moment, their logic tracks. Due to the surge in rental averages, there are in fact several states where it is cheaper to buy.

The state where it is currently best to buy rather than rent is Alabama, with homeowners saving more than 44% on their housing costs. Ah, but let me remind you, the areas where it is cheaper to buy than to rent are the very same smaller cities, primarily across the south and midwest, where competition is heating up due to high demand, and low supply. Alabama only continues this trend. As mentioned previously, the same cities are being scoped out by homeowner's in states like California and New York.

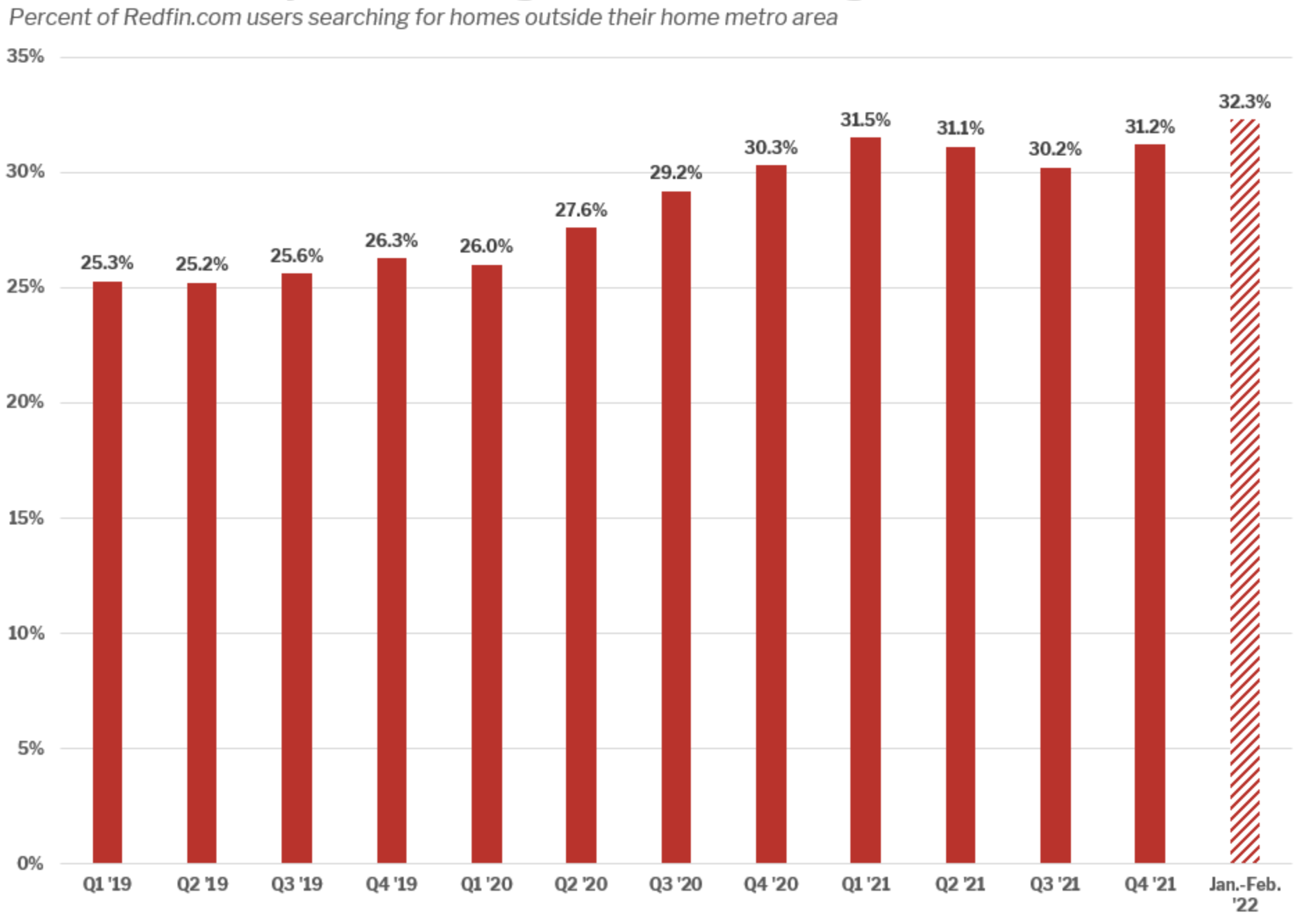

More Migration, More Competition

So let’s recap. There are less houses for sale across the board as people are staying put, leading to a highly competitive market, primarily in “secondary cities,” across the south and midwest.

Younger people are faced with rapidly increasing rent across the nation, though remote work may not tie them to the bigger, more expensive cities where they might be employed. With homeownership likely being unattainable in those big cities, like New York or San Francisco, their options then are to compete to own a home in the high demand, low supply secondary city market. Of course, they could instead continue to rent in the big cities.

Source: Redfin.com

The expectation of an increased supply of houses on the market hinges on the idea that primarily older homeowners are looking to move from “expensive cities” to “cheaper cities.” While you might see some activity from people leaving big cities for more affordable housing, this isn't likely to make things less competitive by adding supply-- it'll continue to increase a competitive pricing surge in the secondary cities they're moving to, and as for the houses in the big cities they'll be putting on the market, prices will remain incredibly high. Any younger people flocking to the cities won't be able to afford to buy.

A third narrative begins to form, where you might see homeowners take advantage of rising rents in coastal cities by leasing their property to young renters, and hightailing it to the south and midwest. Note that this leaves us with a net-zero impact on the market-- continued surge in rental costs, and more competition for scarce property in secondary cities.

There are currently a number of factors at play. Any which way you look at it, you see increased demand, surely, and a small potential for increased supply. But with demand fueled by migration from expensive coastal states to more affordable southern and midwestern states, will more supply in the expensive coastal states make a big difference? Will some choose to take advantage of a population of young renters and increasing rental pricing, and lease their property instead of selling?

We'll be keeping an eye on these trends over at Generes & Associates, and we’ll keep you updated. As always, feel free to reach out and let us know how we can help you or your business.